Helping clients achieve their long term financial goals

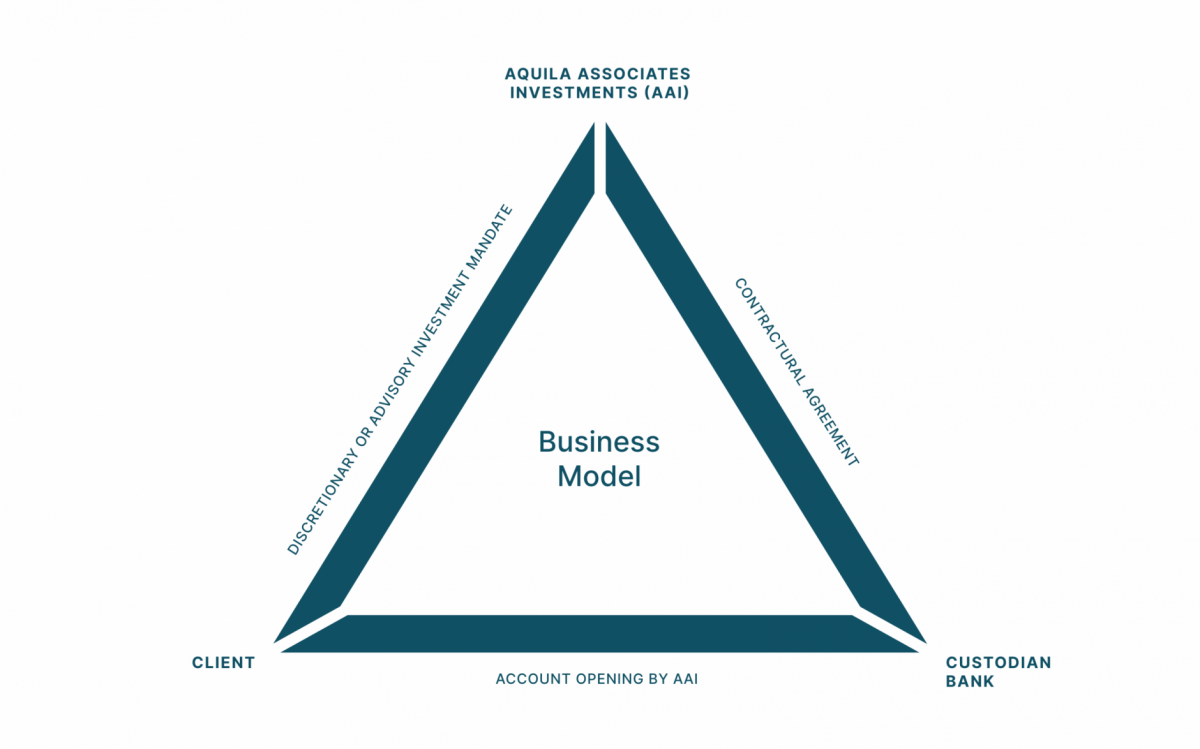

We provide a range of tailored discretionary investment management and advisory services for individuals, families, trusts and corporations.

Every portfolio is individually managed. We construct diversified portfolios to suit clients' individual risk and return requirements. Clients are not presented with “off-the-shelf” solutions. Investments are carefully selected based on our own research. Investments are appropriately weighted and monitored with risk actively managed.

We implement both a “top down” and “bottom up” approach. The investment process and selection is based on fundamental research in conjunction with valuation discipline. Inputs are sourced from external broker and independent research, media, proprietary data and indicators as well as regular analyst, company and fund manager meetings and reports.

We offer a structured investment process with a preference for direct investments in fixed interest and individual equities to minimise costs. We use actively managed and exchange traded funds (ETF's) where specific exposure is required such as in specialist areas like Emerging & Frontier Markets and the Pacific Basin.

We invest primarily in equities, fixed income and precious metals and actively manage all foreign currency exposure to counterbalance exchange rate fluctuations.

We do not invest in structured products except with the client’s express wish.

Key focus on minimizing transaction, product and brokerage costs when implementing investment strategy across all asset classes including foreign exchange.

Regular reporting to and consistent communication with our clients are of paramount importance.

Is your investment portfolio aligned with your financial goals and risk tolerance?

What are your overall investment management costs? Can you further optimize these costs?

CONTACT US FOR A FREE CONSULTATION